Feedback

Dental Benefits Are Different—And That’s a Good Thing

When it comes to insurance, dental coverage stands out—and for good reason. Unlike other types of insurance that focus on emergencies and unexpected events, dental insurance is designed to support your health proactively. This benefit plays a vital role in helping individuals and families maintain good oral and overall health.

The Purpose of Dental Benefits

Dental coverage was created with prevention in mind. It is intended to help:

- Maintain good oral and overall health

- Prevent dental issues that could lead to serious health problems

- Manage dental care costs

- Reduce out-of-pocket expenses

- Improve quality of life

Rather than being a safety net for emergencies, dental insurance is a tool for consistent maintenance. It encourages regular cleanings, exams, and early treatment—making it easier to stay ahead of potential problems.

How Dental Plans Differ from Other Types of Insurance

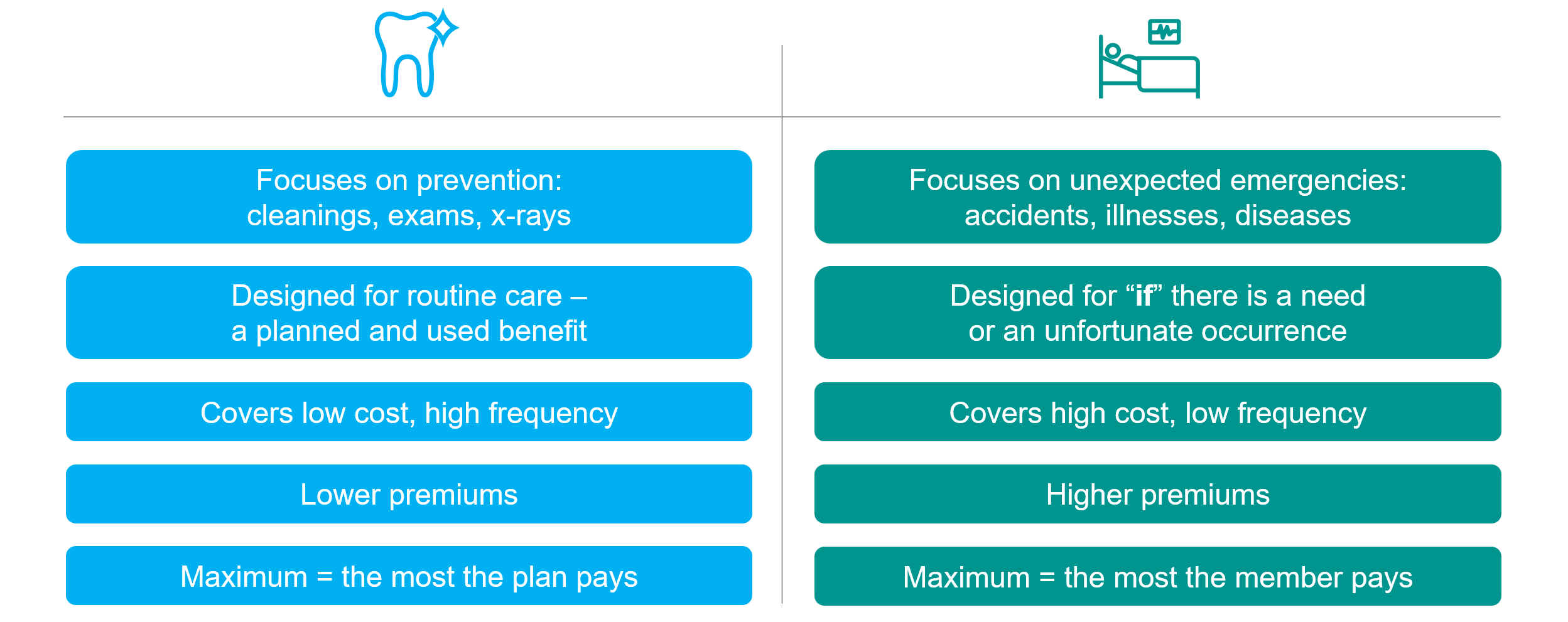

Most insurance plans are designed for "what if" scenarios such as accidents, illnesses, or other unexpected events. Dental plans, on the other hand, are built for prevention through routine care. Here’s how they compare.

This structure makes dental coverage more accessible and budget-friendly while delivering meaningful health benefits.

The Value of Preventive Dental Care

Preventive dental care isn’t just about avoiding cavities—it’s about protecting your overall health. Regular checkups can catch issues early, before they require extensive (and expensive) treatment. In fact, studies show that every dollar invested in preventive dental care can save between $8 to $50 in restorative and emergency treatments.

That’s a powerful return on investment—and a compelling reason to make dental coverage part of your health strategy.

A Benefit that Protects More Than Your Smile

Dental coverage is designed to make routine care affordable and accessible. By enrolling in a dental plan, you’re not just protecting your smile—you’re investing in your long-term health.